Where the techniques of Maths

are explained in simple terms.

Financial Maths - declining balance depreciation.

Test Yourself 1.

- Algebra & Number

- Calculus

- Financial Maths

- Functions & Quadratics

- Geometry

- Measurement

- Networks & Graphs

- Probability & Statistics

- Trigonometry

- Maths & beyond

- Index

| Future value. | 1. A phone depreciates in value at a rate of 25% each year.

A new Pixel 5 costs $999. What will be its value (to the nearest $10) after 3 years? Answer. Value = $420. |

| 2. Ben purchased a laptop for $3,200 and depreciated it using the declining-balance method at 20% p.a.

How much (to the nearest $10) is the laptop worth 4 years after the purchase? Answer. Value = $1,310. |

|

| 3. A new start-up company purchases $132,000 worth of office equipment. The value of the furniture is depreciated using the declining balance method at a rate of 22.5% per annum.

Calculate the value of the equipment after 5 years. Answer.Value = $36,904.76. |

|

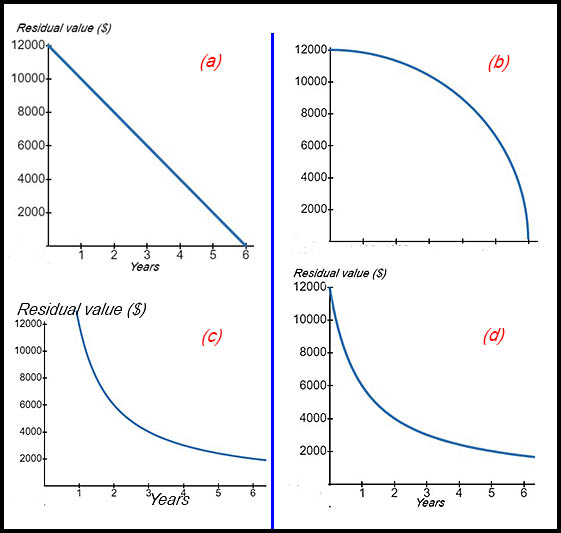

| 4. A photocopier in an office is to be depreciated using the declining balance method. It was purchased new for $12,000 and depreciated by about $10,000 after 6 years of use.

Which of the following graphs best shows the value of the photocopier over this period? Give reasons for your answer.

|

|

5. An asset is depreciated at 10% per half year using the declining balance method. The asset was originally purchased for $15,000. What is the salvage value of this asset (to the nearest dollar) after 4 years? Answer. $6,457. |

|

| Present value. | 6. Ish purchased a Tablet to help with her Maths three years ago.

It is now valued at $350 and it has depreciated using the declining balance method at the rate of 25% each year. How much did Ish pay (to the nearest dollar) for the Tablet originally? Answer. Original price: $830. |

| 7. | |

| 8. | |

| 9. | |

| 10. | |

| Rate of depreciation. | 11. Charles buys a car for $25,000. After 5 years, the value of his car - using the declining balance method - is $8,900.

Calculate the percentage rate of depreciation on Charles' car (to one decimal place). Answer. Rate is 18.7%. |

| 12. Euan purchases some equipment for his business and wishes to depreciate its value over 6 years.

He pays $43,600 for the equipment and after one year, the value depreciates to $36,188. Answer.(i) Depreciation rate is 17% p.a. (ii) Write off value is $14,254. |

|

13. David is interested in buying a boat. He sees a boat he likes whose value is $38,000. He makes no decision but sees the same boat one year later. Its price is now down to $34,000 and the owner Miguel says the decrease is in line with its rate of depreciation.

Answer.(i) Rate is 10.5%. (ii) Value following year is $28,220. (iii) Value 4 years ago was $80,070. |

|

| 14. A computer was purchased 3 years ago for $3,000. Its value has depreciated - using the declining balance method - so that its value is now $1,500.

What is the rate of depreciation of the computer (to the nearest %). Answer.Rate = 26%. |

|

| Number of periods - Hint: use guess and check. |

15. A PS4 console was purchased for $1400 a number of years ago. It is now valued at $400 after depreciating at a declining balance rate of 23% per year.

Approximately how many years ago was the PS4 purchased? Answer. Purchased about 5 years ago. |